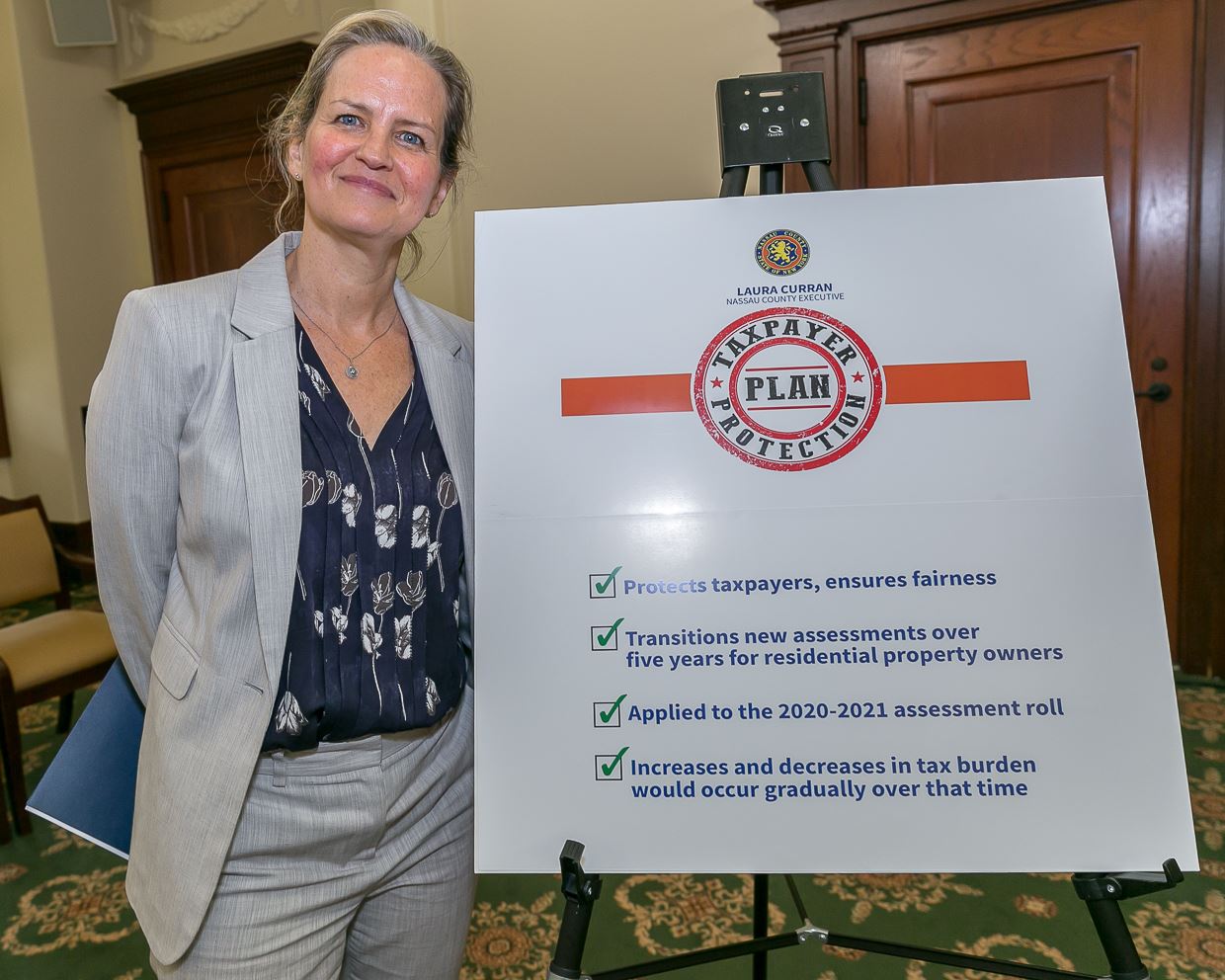

MINEOLA, NY – Today, Nassau County Executive Laura Curran filed local legislation to ensure her Taxpayer Protection Plan, included in New York State’s 2019-2020 Budget, would take effect in time for the 2020-2021 final assessment roll. County Executive Curran, joined by Minority Leader Kevan Abrahams, Legislator Mulé and Legislator Birnbaum, is calling for immediate action by the Nassau County Majority of the Legislature to calendar and pass this local legislation to protect taxpayers. Curran’s Taxpayer Protection Plan will secure exemptions for class one residential property owners experiencing valuation increases as a result of the first countywide reassessment in nearly a decade. The plan will effectively spread out any relative changes, increases and decreases, in tax burden due to the reassessment, over a five-year period.

“After years of inaction, I inherited a broken assessment system from the Mangano Administration. I promised to bring back fairness and accuracy to the process,” said Curran. “I’ve made it my number one priority to secure a Taxpayer Protection Plan to smooth out the tax impact of the reassessment to protect property owners. I greatly appreciate the support of our residents from Governor Cuomo, our State Senate and our State Assembly and I am urging our local Legislature to complete the final step and enact this law locally. Especially for residents on a fixed income, this phase-in exemption is crucial.”

"This approach offers important protections to residents as we continue to repair the damage caused by eight years of frozen tax rolls under the Mangano Administration and a Republican majority. County Executive Curran should be commended for taking steps to restore accuracy and integrity to the County's assessment system," said Mulé.

Curran recommends residents contact their local Legislator by calling 516-571-6200, ext. 7 to urge them to pass this vital legislation immediately.

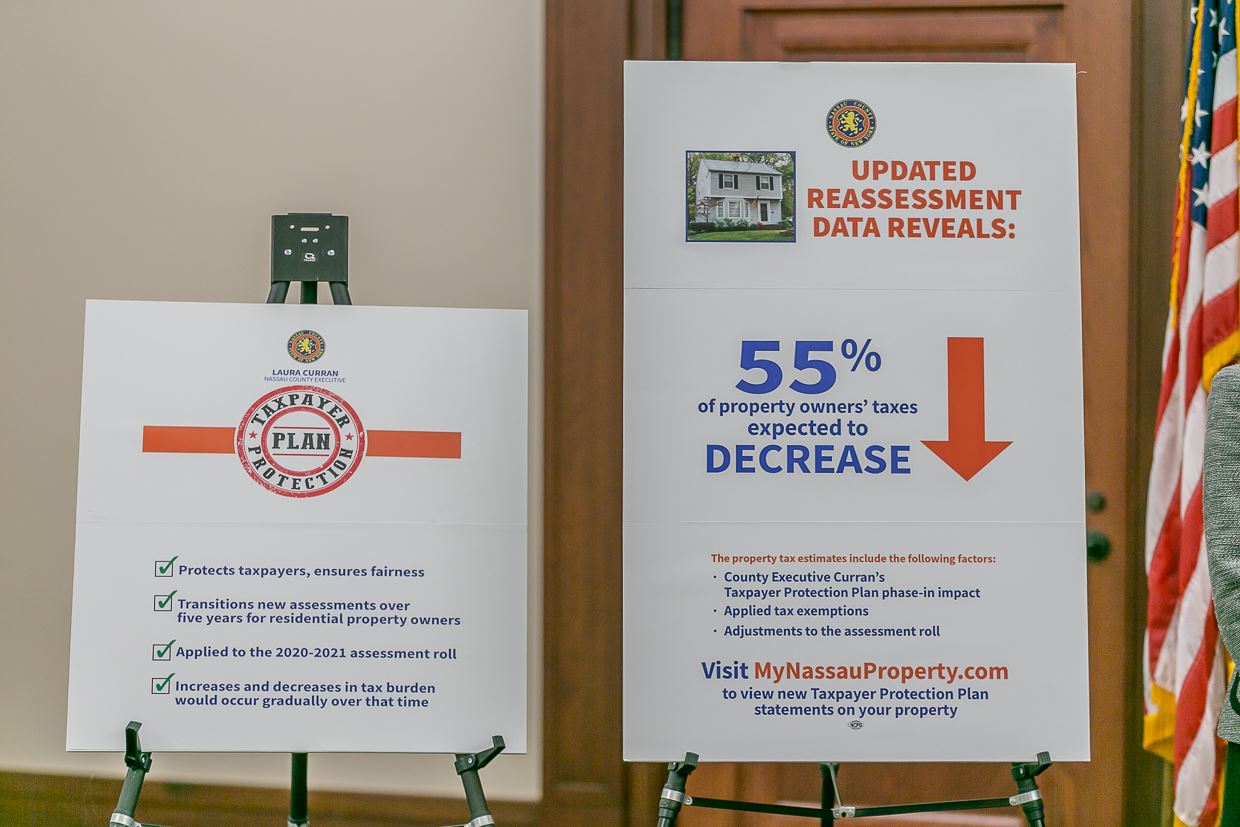

More Homeowners Expected to See DECREASE in Property Taxes

Continuing to restore accuracy to the County’s property assessment system, Curran was joined by County Assessor David Moog to share new data that shows more than half of Nassau County’s residential property owners will see a decrease in their property taxes as a result of the reassessment, exemptions and phase-in plan. New Taxpayer Protection Plan statements that show hypothetical estimated property taxes for the 2020-2021 tax year are being prepared and will be available online at mynassauproperty.com in the coming weeks.

“My Administration completed the challenging reassessment process and produced more accurate updated values for every property in Nassau County,” said Curran. “Property is worth much more than it was the last time it was assessed, almost a decade ago – that’s a great thing about living in Nassau County. But – I want to be clear - just because your assessed value increased, it doesn’t mean your property taxes increased. I am pleased to share this new data which I hope provides some clarity for taxpayers while we put the assessment roll on the road to fairness and equity.”

The new estimates show property taxes going down for 55% of residential property owners. The estimates in the Taxpayer Protection Plan statements are based on county, town, special district and school district taxes for the most recently-completed tax year of 2018-2019 and newly-assessed home values produced by the Department of Assessment and two renowned outside vendors. The estimates in the statements also include the following factors:

- eligibility for tax exemptions including Senior Citizen, Star, Enhanced Star and Veterans;

- adjustments to the assessment roll from taxpayer inputs throughout the preliminary period;

- successful grievances with the Assessment Review Commission (ARC) for tax year 2018-2019; and

- the impact of the five-year phase in.

“I look forward to the Nassau County Legislature adopting my Taxpayer Protection Plan to secure relief for our County’s taxpayers,” said Curran.